Collect What is due: Effective Association Collection Strategies and Policies

Reading Time: 3 minutes

One of the most consistent challenges for condominium association boards in Florida is receiving dues and assessments in a timely fashion. Therefore, it is vital for a COA or HOA to apply effective association collection strategies as part of their management activity. This video presentation recorded by attorney Brittany N. Snell outlines effective association collection strategies and policies in Florida. She covers the various methods for collecting past-due assessments from property owners, addressing lender foreclosure actions, dealing with owner bankruptcy actions and collecting from tenants when the unit owners are delinquent.

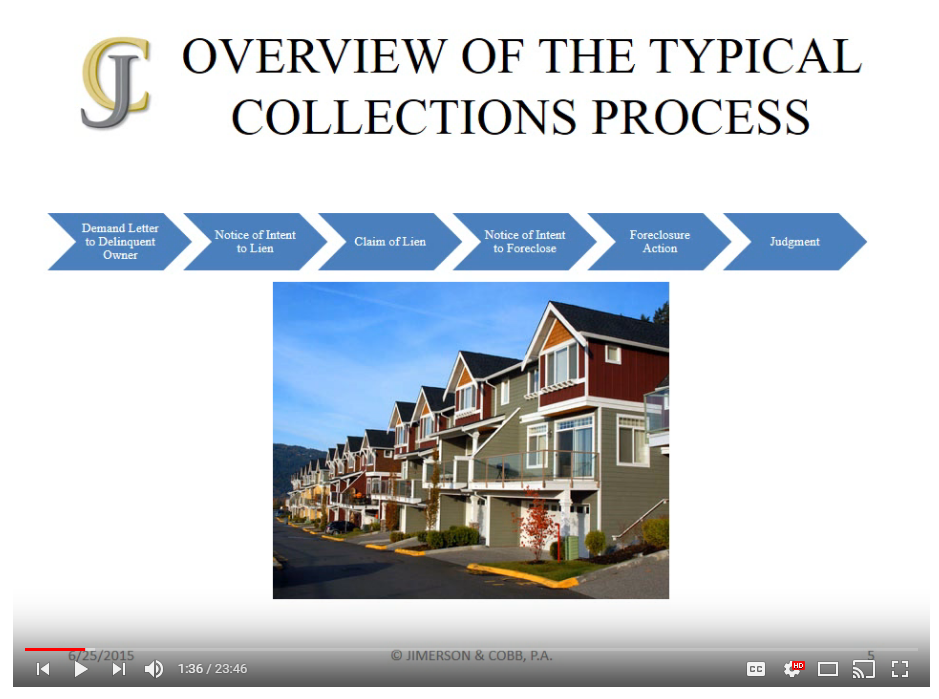

To access the presentation, visit YouTube or click play on the embedded image below. The length of the presentation is 23:46.

https://youtu.be/gLznTT8y1BE

Association Collection Strategies For Collecting From Unit Owners

There is a typical collections process that includes a demand letter, notice of intent to lien, claim of lien, notice of intent to foreclose, foreclosure action and judgment. However, there a number of things that can happen to derail a collection effort. Therefore, condominium associations should be sure to stay on schedule with each of the deadlines to help ensure success:

- The Association must be able to provide an estoppel certificate within 15 days of request.

- The Board can send a demand letter once an owner becomes 30 days deliquent.

- The Board may suspend the voting rights and rights to use common elements for an owner that is 90 days delinquent.

- A Condominium Association must provide a 30-day written notice of the intent to lien prior to filing a claim of lien.

- A Homeowners Association must provide a 45-day written notice of the intent to lien prior to filing a claim of lien.

- The Claim of Lien is valid for one year from the filing.

- A Condominium Association must provide a 30-day written notice of the intent to foreclose the claim of lien before it can initiate foreclosure proceedings.

- A Homeowners Association must provide a 45-day written notice of the intent to foreclose the claim of lien before it can initiate foreclosure proceedings.

Association Collection Strategies For Collecting When The Lender Forecloses

If a leader forecloses on a property that is delinquent within your condominium association, you should be sure to:

- Determine the priority of the lien (are there currently other claims on the property?)

- Determine the owner’s assets (are there currently funds available to pay what’s due?)

- Consider whether to request an order to show cause (speeds up the lender foreclosure action)

Association Collection Strategies For Collecting From Tenants

Florida Statutes allow associations to pursue monies due from delinquent unit owners by obtaining tenant rent payments. Therefore, once written notice is provided to the tenant, their rent payments can be redirected to the association.

Association Collection Strategies For Collecting When Ownership Changes

Collections in this instance depend on who is the new owner of the delinquent property, whether they are:

- An individual;

- The first mortgage holder; or

- The association.

Association Collection Strategies For Collecting When The Unit Owner Files Bankruptcy

Many associations in Florida run into this issue. An association may seek an action in rem, or reinstate an action against the unit owner, when the bankruptcy is discharged.

Conclusion

It is critical that associations understand Chapter 718 and Chapter 720. That way they can apply collection strategies and policies that keep payments current in the community.