Florida Business Break-up 101: Issues, Mechanisms, Planning, Forcing, Defending and Valuation

Reading Time: 2 minutes

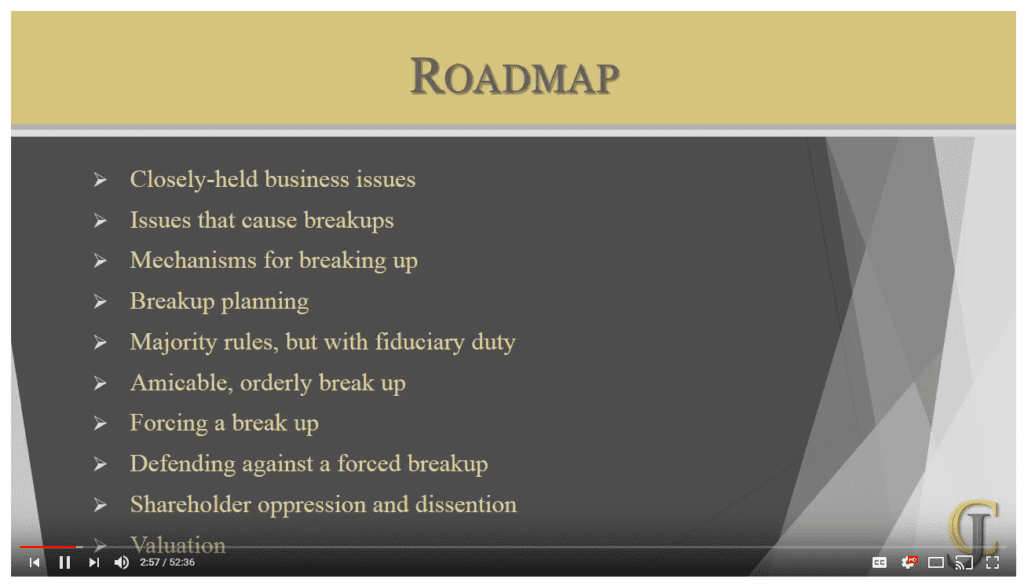

A Florida business break-up can be messy. However, it doesn’t have to be that way. Instead, owners of a business who plan ahead with consideration of potential future challenges can help ensure an amicable break-up, free of drama or difficulty. And by having an experienced contract law attorney in your corner, this outcome is even more likely. This video presentation recorded by Austin B. Calhoun covers the Florida contract law issues which owners of closely-held businesses must consider when they are deciding to break-up.

To access the presentation, visit YouTube or click play on the embedded image below. The length of the presentation is 52:36.

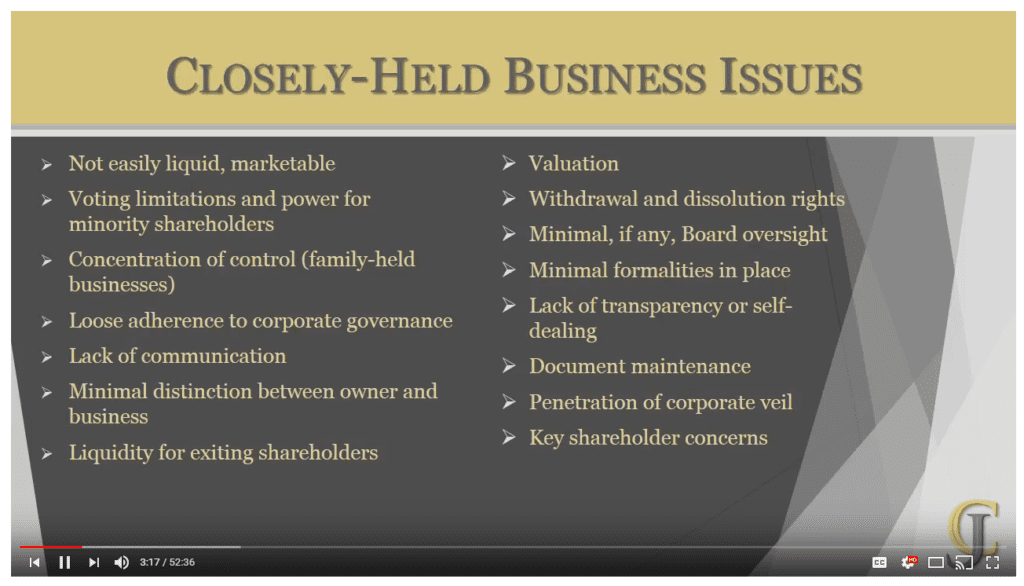

Closely-Held Business Issues That Cause Break-ups

The reasons for a business break-up can be varied, as all companies come in different shapes and sizes. Perhaps there has been a fraud committed. Or maybe, some perceived inequity. Or even, slight or major disagreement on fundamental business decisions.

Financial events such as retirement or bankruptcy can be contributing factors. Also, an owner may observe some perceived benefits elsewhere, and they want to pursue an alternative investment. Last but not least, sometimes unforeseen circumstances like death, disability or a decline of the market can determine the end of an enterprise.

In any of these cases, the most important thing is resolving conflicts quickly and fairly to all parties. Otherwise, there could be major implications. Therefore, start by considering of the mechanisms for a Florida business break-up under the law:

- Buy-out or dissolve the company

- Negotiated resolution

- Freeze-out, termination or squeeze-out merger

- The courts

Being Proactive To Avoid Unintended Consequences

It’s important for all parties to agree upon key provisions. As a result, resolution is more likely to be made quickly and satisfactorily. It’s no guarantee, but it certainly can help. Therefore, begin with preventative corporate planning. Also, be sure to keep your agreement updated. Last but not least, discuss and outline the consequences for the eight D’s:

- Death

- Divorce

- Disability

- Dissention

- Dissolution

- Departure

- Debt overload

- Decline of market

Additional Subject Content Covered In Presentation On A Florida Business Break-up

Following the introductory considerations, Austin dives into the remaining topics to help you in effectively business break-up. These include:

- Break-up planning

- Majority rule, but with fiduciary duty

- Amicable, orderly break-up

- Forcing a break-up

- Defending against a forced break-up