What do sourcing price quotes for Opportunity Zone construction and redevelopment services encompass?

In the context of Opportunity Zone investment services in Florida, sourcing price quotes from contractors and developers for construction and redevelopment services is critical. The Opportunity Zones program offers tax incentives for investing in economically distressed communities, leading to potential business development and job creation. Contractors and developers are pivotal in actualizing these investments through construction and redevelopment projects.

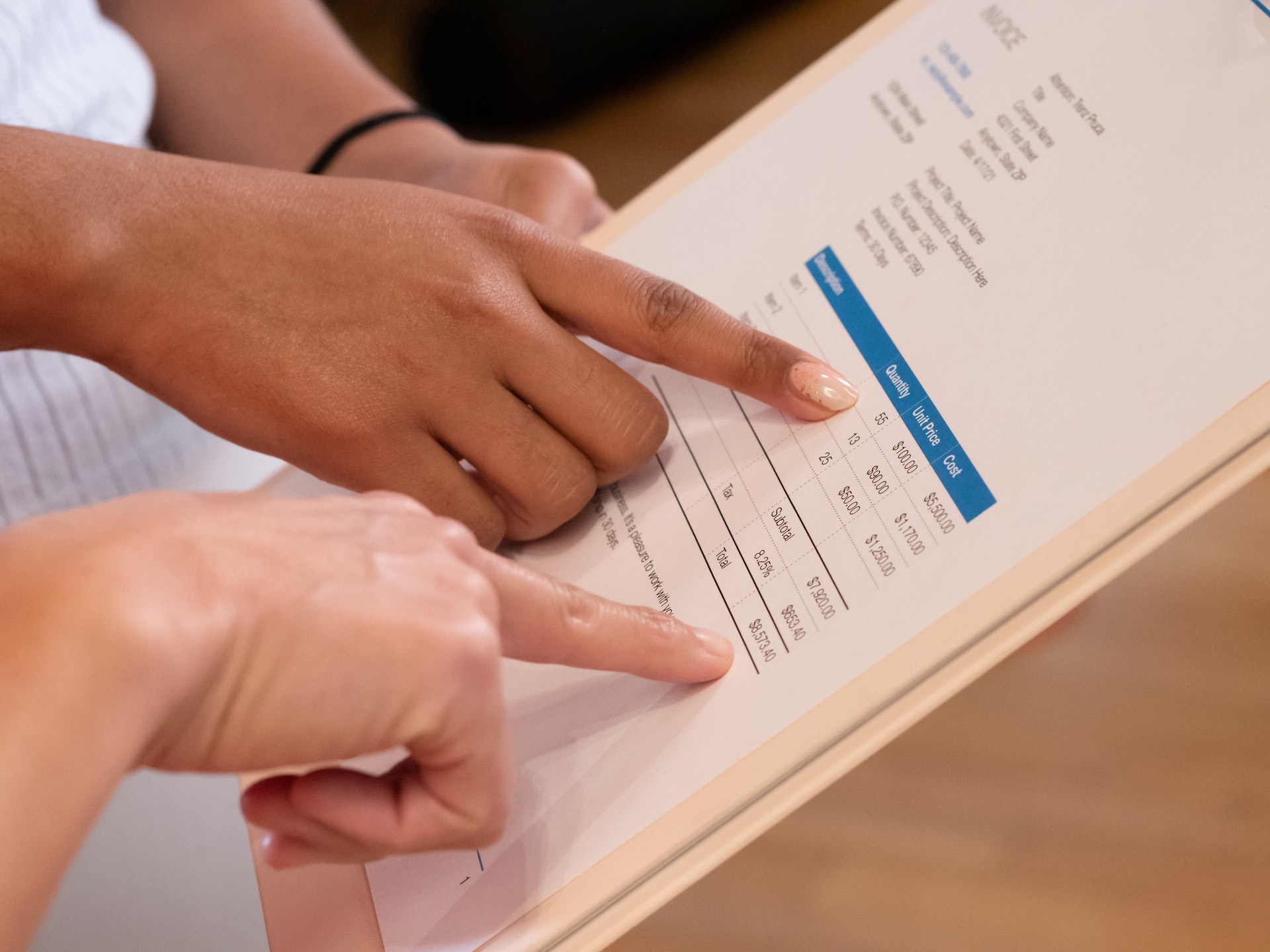

An example of sourcing price quotes involves an investor in Florida interested in redeveloping a commercial property within an Opportunity Zone. They would seek price quotes from multiple contractors and developers experienced in similar projects. This process may involve issuing a Request for Proposal (RFP) and evaluating submitted proposals based on various factors, including cost, quality, and experience. The investor then selects a contractor or developer that best meets their requirements, ensuring the successful completion of the project under Florida and federal law.

Need a commercial leasing advocate? Schedule your consultation today with a top Opportunity Zone investing attorney.

Which laws and regulations apply to sourcing price quotes for Opportunity Zone construction and redevelopment services in Florida?

Various Florida and federal laws and regulations govern the process of sourcing price quotes from contractors and developers for Opportunity Zone construction and redevelopment services. At the federal level, the Internal Revenue Code § 1400Z-1 and § 1400Z-2 provide the legal framework for the Opportunity Zones program, including the tax benefits and requirements for qualifying investments.

At the state level, Florida Statutes Chapter 288 governs commercial economic development, including incentives for investment in economically distressed communities. In addition, specific regulations, such as the Florida Building Code and local zoning ordinances, apply to the construction and redevelopment process.

Investors should consult legal professionals to ensure compliance with all applicable laws and regulations when sourcing price quotes from contractors and developers for Opportunity Zone construction and redevelopment services in Florida.

What are the strategic benefits of sourcing price quotes for Opportunity Zone construction and redevelopment services?

Investors may benefit from the following:

- Cost-effectiveness: By obtaining multiple price quotes, investors can compare and select the most competitive and cost-effective proposal that aligns with their project budget, ultimately maximizing the return on investment.

- Quality assurance: Evaluating contractors and developers based on their experience, track record, and proposed methodologies helps ensure that the chosen contractor will deliver high-quality construction and redevelopment services.

- Risk mitigation: Properly vetting contractors and developers can reduce potential risks associated with construction delays, cost overruns, and regulatory non-compliance, which could jeopardize the Opportunity Zone investment.

- Tax incentives: Ensuring compliance with the Opportunity Zone program’s requirements can maximize the available tax benefits for the investor, including capital gains deferral, reduction, or even elimination.

- Local impact: Selecting contractors and developers with knowledge of local regulations and community needs can enhance the project’s positive impact on the surrounding area, contributing to the revitalization and economic growth of the Opportunity Zone.

Please contact our office to set up your initial consultation to determine whether Opportunity Zone investment services may be available for your unique situation.

What steps should counsel take to facilitate sourcing price quotes for Opportunity Zone construction and redevelopment services?

Counsel should consider the following to protect their clients:

- Research: Counsel should thoroughly research and understand Florida and federal laws and regulations governing Opportunity Zone investments and construction projects.

- Develop a Request for Proposal (RFP): Counsel should assist in drafting a comprehensive RFP that outlines the project scope, requirements, and evaluation criteria, ensuring alignment with Opportunity Zone program guidelines and any applicable local and state regulations.

- Review proposals: Legal counsel should help evaluate submitted proposals, ensuring that the selected contractor or developer has the necessary licenses, insurance, and qualifications to comply with all relevant laws and regulations.

- Negotiate contracts: Counsel should negotiate and draft agreements with the chosen contractor or developer, incorporating clear terms and conditions that protect the investor’s interests and ensure compliance with the Opportunity Zones program and other applicable laws.

- Monitor progress: Throughout the construction or redevelopment process, legal counsel should maintain communication with the contractor or developer, monitor progress, and address any issues or concerns that may arise, ensuring ongoing compliance and successful project completion.

When a set of facts is appropriate for legal intervention, there are many paths a claimant may take. We are value-based attorneys at Jimerson Birr, which means we look at each action with our clients from the point of view of costs and benefits while reducing liability. Then, based on our client’s objectives, we chart a path to seek appropriate remedies.

To determine whether your unique situation may necessitate litigation or another form of specialized advocacy, please contact our office to set up your initial consultation.

Frequently Asked Questions

- How do I find reputable contractors and developers for Opportunity Zone projects in Florida?

To find reputable contractors and developers, research their past work, verify their licenses and insurance, and seek recommendations from industry professionals. Familiarize yourself with Florida Statutes Chapter 489 for licensing requirements and other regulations.

2. Are there any specific requirements for construction projects within Opportunity Zones?

Yes, construction projects within Opportunity Zones must adhere to federal guidelines outlined in the Internal Revenue Code § 1400Z-1 and § 1400Z-2. Additionally, local and state regulations may apply. Consult legal counsel to ensure compliance with all applicable laws and regulations.

3. When must I complete the construction or redevelopment project within an Opportunity Zone to benefit from tax incentives?

Investors must substantially improve the property within 30 months after acquisition to qualify for tax incentives. Failure to meet this deadline may result in losing eligibility for the tax benefits associated with the Opportunity Zones program.

Have more questions about how Opportunity Zone investing could impact you?

Crucially, this overview of sourcing price quotes for Opportunity Zone construction and redevelopment services does not begin to cover all the laws implicated by this issue or the factors that may compel the application of such laws. Every case is unique, and the laws can produce different outcomes depending on the individual circumstances.

Jimerson Birr attorneys guide our clients to help make informed decisions while ensuring their rights are respected and protected. Our lawyers are highly trained and experienced in the nuances of the law, so they can accurately interpret statutes and case law and holistically prepare individuals or companies for their legal endeavors. Through this intense personal investment and advocacy, our lawyers will help resolve the issue’s complicated legal problems efficiently and effectively.

Having a Jimerson Birr attorney on your side means securing a team of seasoned, multi-dimensional, cross-functional legal professionals. Whether it is a transaction, an operational issue, a regulatory challenge, or a contested legal predicament that may require court intervention, we remain tireless advocates at every step. Being a value-added law firm means putting the client at the forefront of everything we do. We use our experience to help our clients navigate even the most complex problems and come out the other side triumphant.

If you want to understand your case, the merits of your claim or defense, potential monetary awards, or the amount of exposure you face, you should speak with a qualified Jimerson Birr lawyer. Our experienced team of attorneys is here to help. Call Jimerson Birr at (904) 389-0050 or use the contact form to schedule a consultation.

We live by our 7 Superior Service Commitments

- Conferring Client-Defined Value

- Efficient and Cost-Effective

- Accessibility

- Delivering an Experience While Delivering Results

- Meaningful and Enduring Partnership

- Exceptional Communication Based Upon Listening

- Accountability to Goals