The Bankruptcy Code: The Automatic Stay – How it Impacts Debtors, Creditors and Trustees

Reading Time: 2 minutes

What happens when a debtor is granted an automatic stay in bankruptcy court? Essentially, it halts creditors and potential creditors from trying to collect pre-bankruptcy debts. However, there are exceptions which may be relevant to your case. This video presentation explains the automatic stay as set forth in the U.S. bankruptcy code. He also describes how it can impact different types of creditors, claims and debts.

To access the presentation, visit YouTube or click play on the embedded image below. The length of the presentation is 27:22.

Introduction To The Automatic Stay

When you fully understand the automatic stay, it’s clear why many consider it:

- a benefit to debtors;

- detriment to creditors; and

- blessing to trustees.

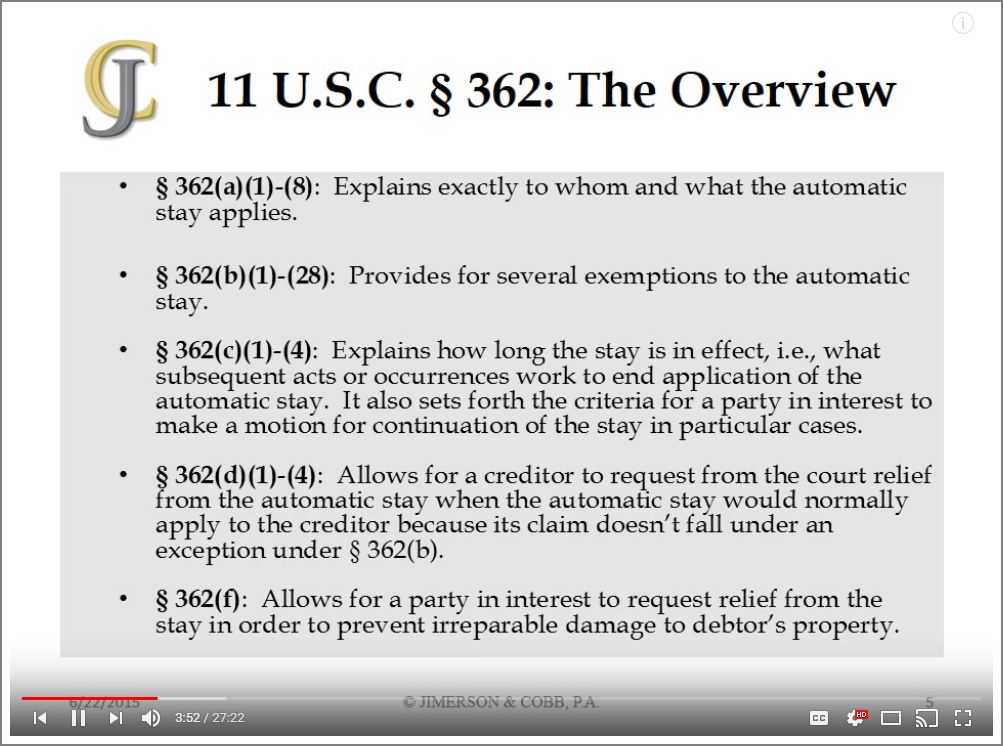

Overview Of The Law

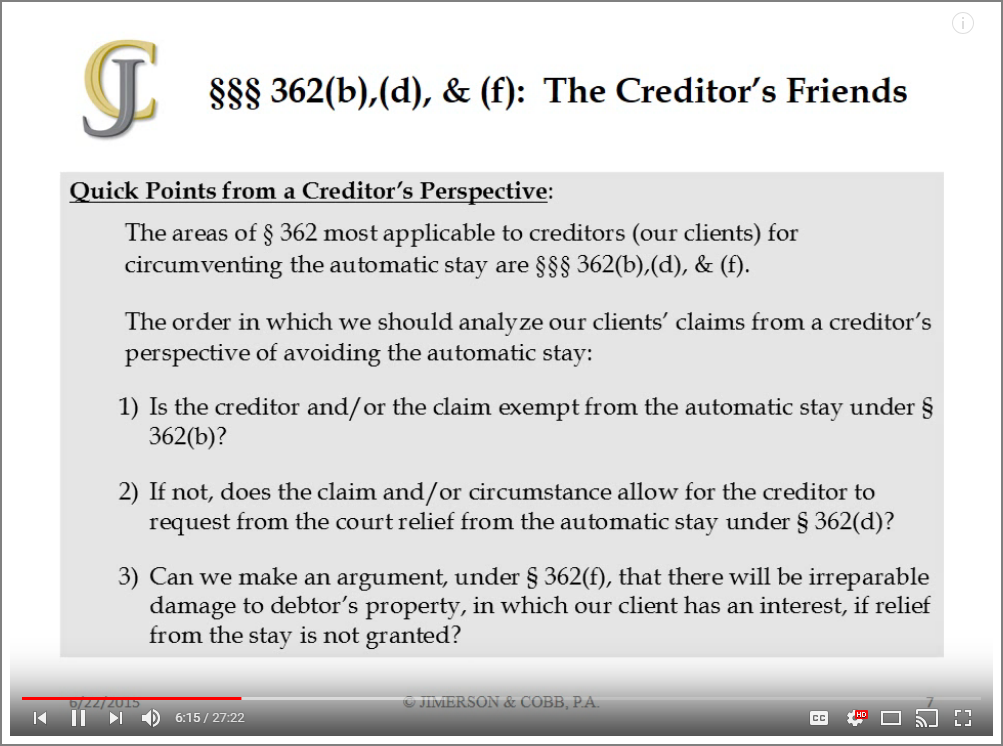

The automatic stay is codified in 11 U.S.C. § 362. It is applicable to Chapter 7, 11 and 13 cases. Whether you are a secured creditor, unsecured creditor or undersecured creditor, these are the key questions to ask:

- Are you and/or the claim exempt from the automatic stay under § 362(b)?

- If not, does the claim and/or circumstance allow for you to request court relief from the automatic stay under § 362(d)?

- If not, will there be irreparable damage to the debtor’s property (in which you have an interest), if relief from the stay is not granted under §362(f)?

Avoid Violating The Bankruptcy Code

Creditors should not violate an automatic stay if granted. That’s because, by violating the stay, a creditor opens themselves up to risk. The presentation details some of the relevant cases where creditors violated the stay:

- In re Estrada, 439 B.R. 227 (Bankr. S.D.Fla. 2010)

- In re Draper, 237 B.R. 502 (Bankr. M.D.Fla. 1999)

In these cited cases, the courts found in favor of the debtor because of the violation. If in doubt, don’t hesitate to contact Jimerson Birr so we may assist you in exploring options for your defense.