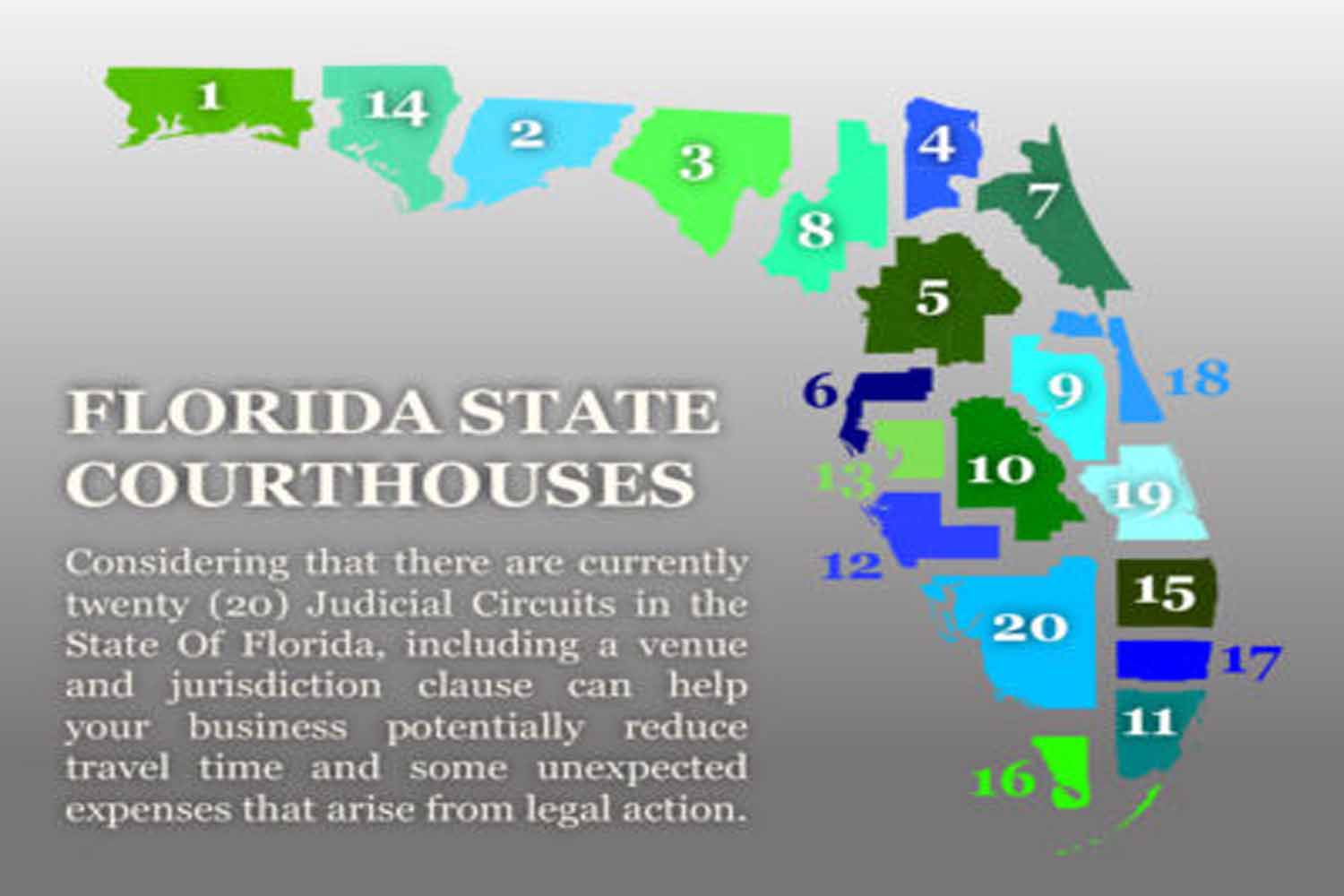

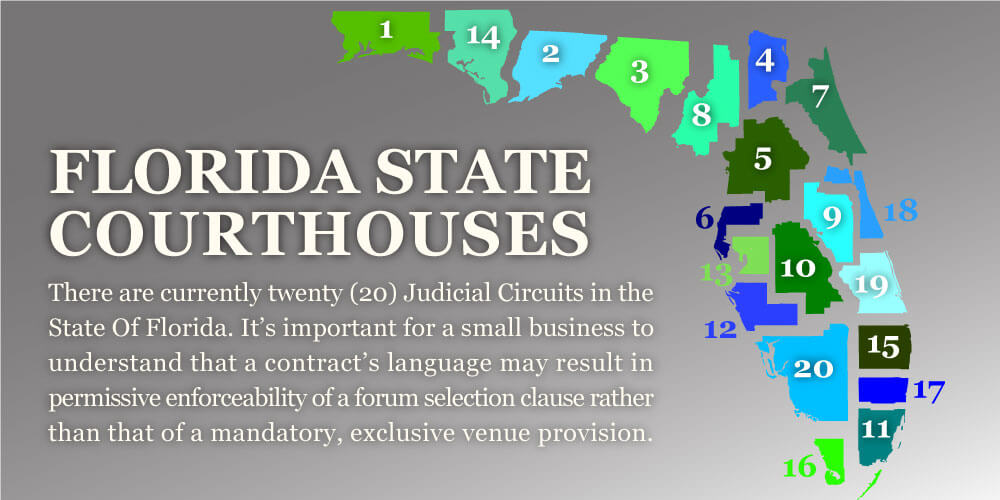

An exclusive venue provision, or commonly referred to as a forum selection clause, is an integral part of every small business contract. Including an exclusive venue provision in a small business contract is extremely important for a small business that provides labor, materials or services to clients located in different […]