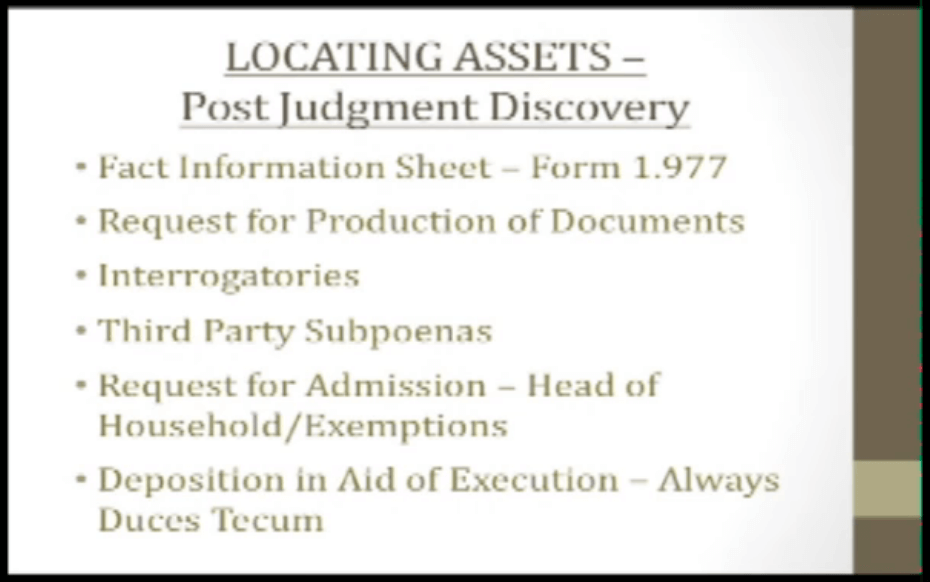

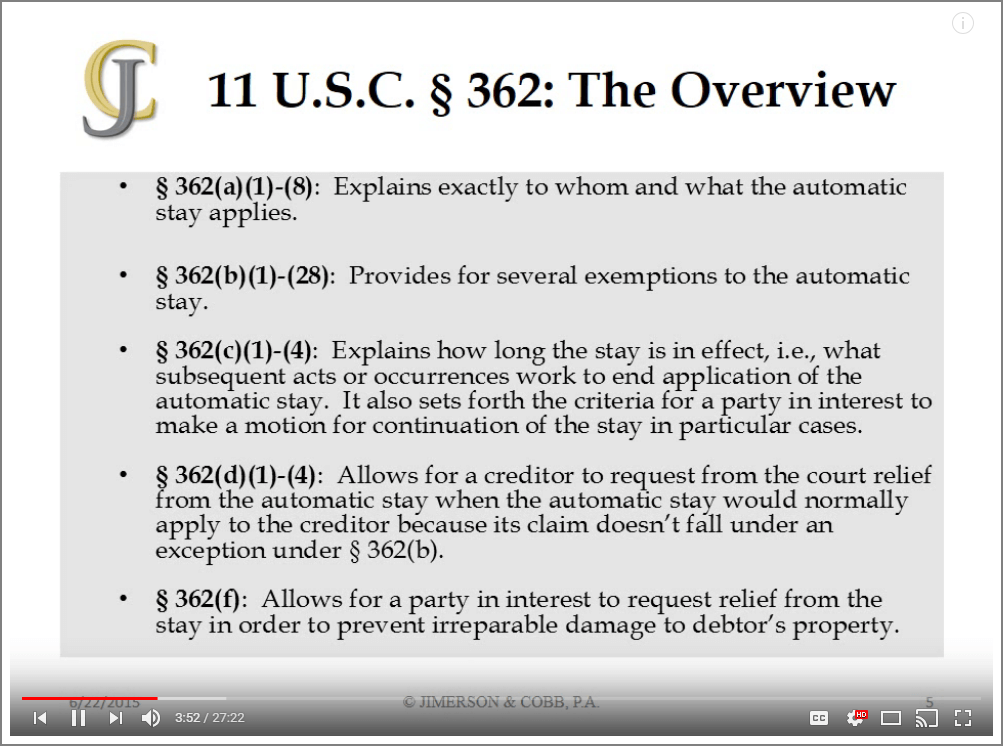

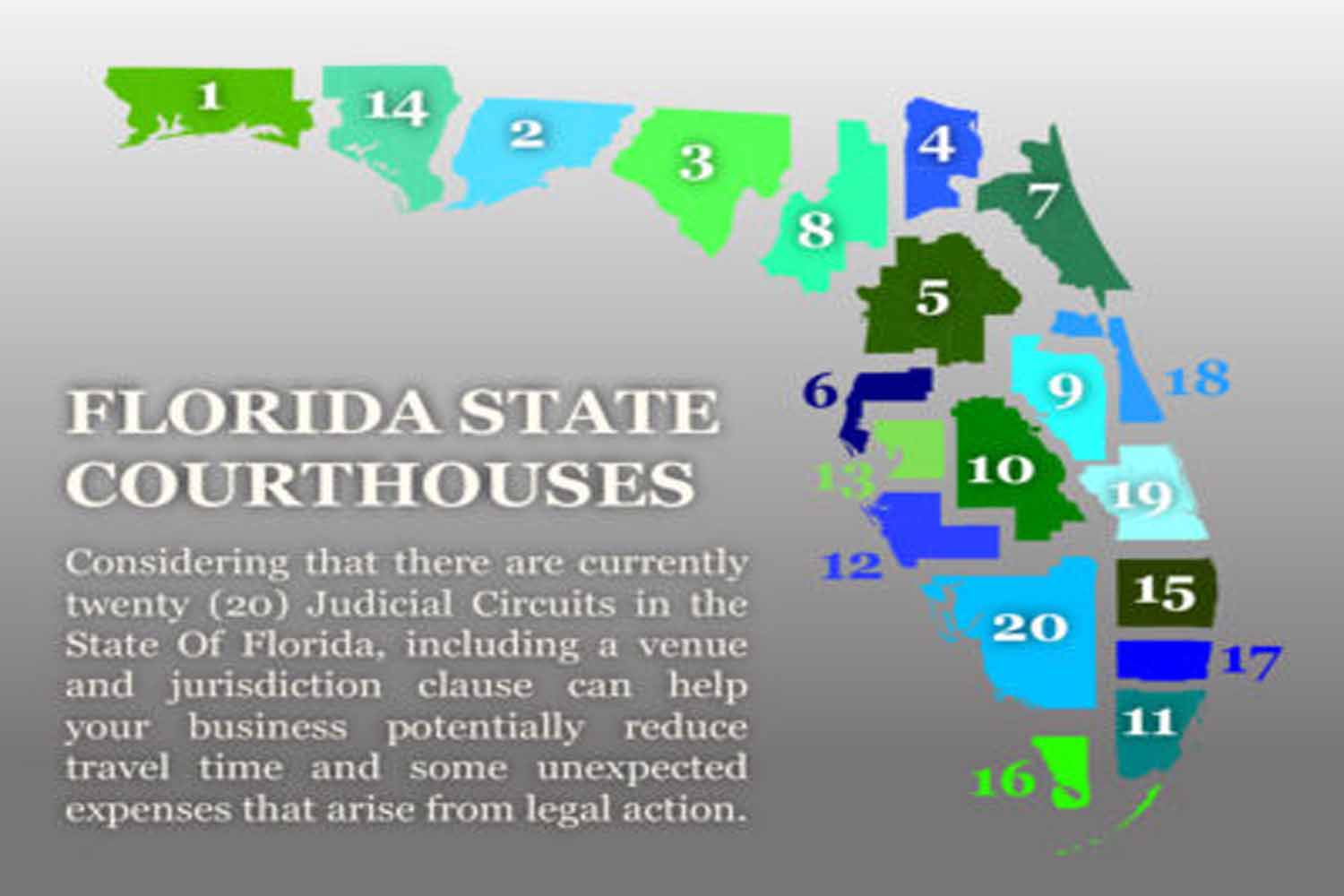

Often times the most challenging part of operating a business is ensuring you’re getting paid for your efforts. This involves the effective and efficient handling of delinquent customers, including formal legal action and collection methods. Part I of this blog series discussed the importance of having a written collection policy […]