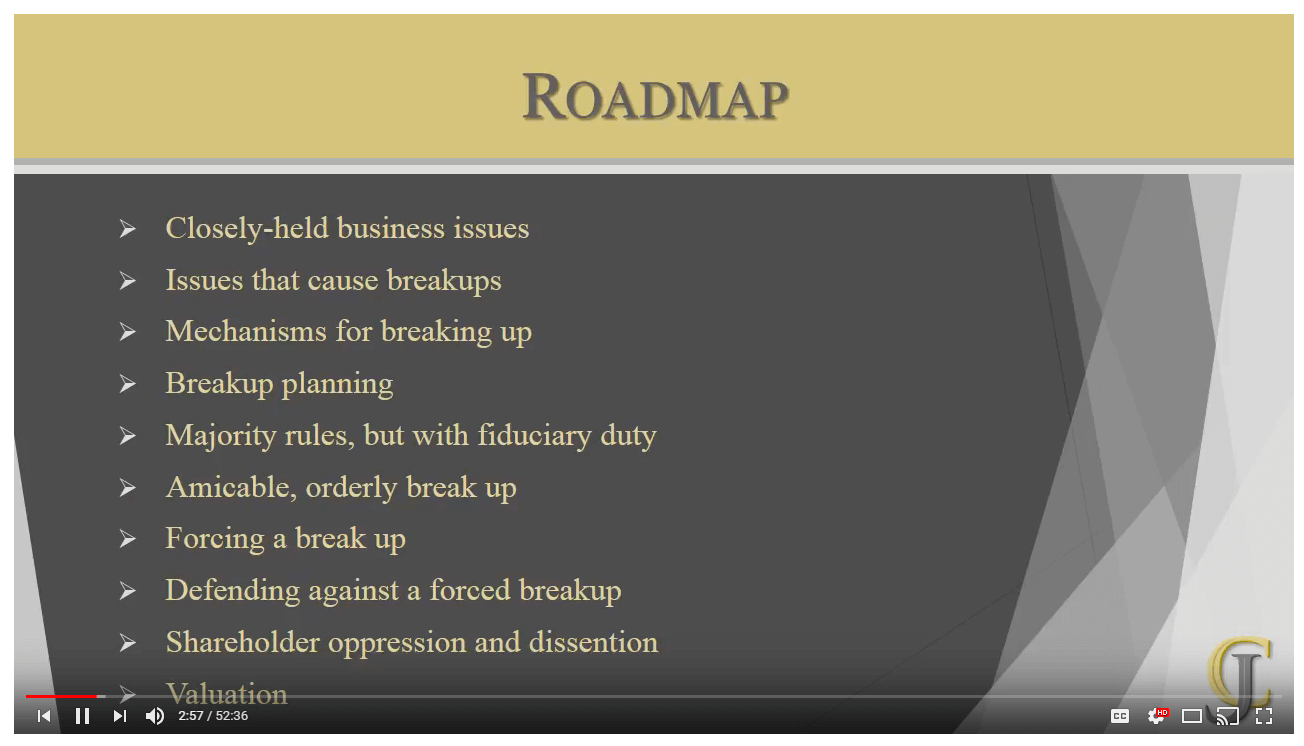

A Florida business break-up can be messy. However, it doesn’t have to be that way. Instead, owners of a business who plan ahead with consideration of potential future challenges can help ensure an amicable break-up, free of drama or difficulty. And by having an experienced contract law attorney in your […]